ETH Price Prediction: Path to $5,000 Amid Technical and Fundamental Crosscurrents

#ETH

- Technical Positioning: ETH trades below key moving averages but near Bollinger Band support, with MACD suggesting potential momentum shift

- Institutional Support: Growing treasury holdings and BitMine's accumulation target provide substantial buying pressure potential

- Market Dynamics: Seasonal trends and Layer-2 innovation counterbalance near-term liquidity and leverage concerns

ETH Price Prediction

ETH Technical Analysis: Key Levels to Watch

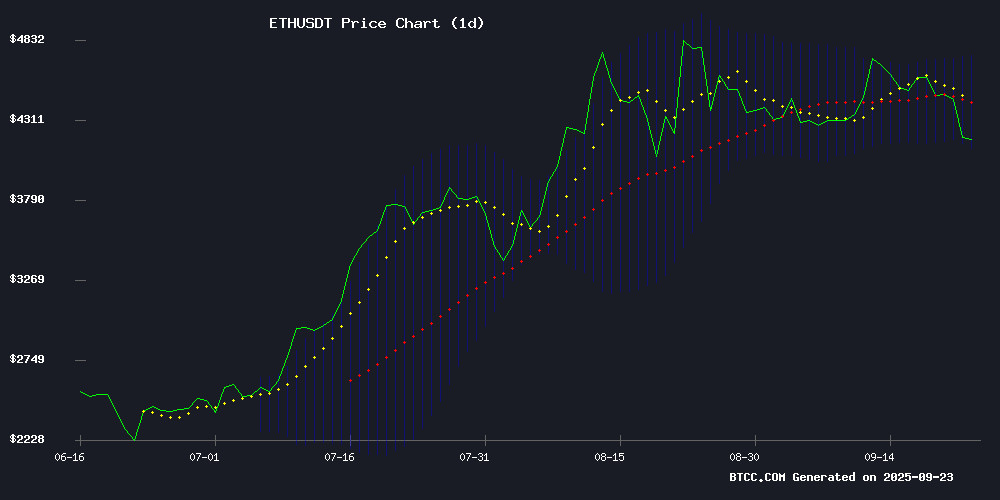

ETH is currently trading at $4,184.67, below its 20-day moving average of $4,428.62, indicating short-term bearish pressure. The MACD reading of -62.97 shows ongoing downward momentum, though the narrowing gap between MACD and signal line suggests potential slowing of the decline. Bollinger Bands position the current price NEAR the lower band at $4,125.97, which could act as support. "The $4,000 level represents a critical psychological and technical threshold," says BTCC financial analyst Robert. "A sustained break below this could trigger further selling pressure."

Market Sentiment: Mixed Signals Amid Institutional Activity

Recent news highlights both bullish and bearish factors for Ethereum. BitMine's accumulation reaching 2% of total ETH supply demonstrates growing institutional interest, while $18B in ethereum treasuries indicates strong holder confidence. However, concerns about leverage and $10B staking withdrawals create near-term headwinds. "The combination of institutional accumulation and seasonal Q4 trends provides a constructive backdrop," notes BTCC financial analyst Robert. "But traders should monitor the $4,000 support level closely given current liquidity concerns."

Factors Influencing ETH's Price

BitMine Reaches 2% of Total ETH Supply, Eyes 5% Target

BitMine Immersion Technologies has crossed a significant threshold by accumulating 2.4 million ETH, equivalent to 2% of Ethereum's total circulating supply. At current valuations, the holdings are worth approximately $10 billion. The firm's long-term ambition—dubbed 'Alchemy of 5%'—aims to secure 6 million ETH, a MOVE Chairman Tom Lee ties to Ethereum's growing role in institutional finance and AI-driven blockchain adoption.

Lee highlighted BitMine's accelerating traction, noting its share price surged from $38 to $61 since early August as ETH holdings doubled. The company concurrently announced a $365 million direct offering at $70 per share, signaling aggressive capital deployment. ethereum treasury entities have absorbed 5.25 million ETH year-to-date, with BitMine commanding 46% of that total.

Ethereum vs. World Liberty Financial: Which Cryptocurrency Could Be a Millionaire-Maker?

As the crypto sector heats up, investors are eyeing Ethereum (ETH) and World Liberty Financial (WLFI) for potential life-changing returns. Ethereum, the second-largest cryptocurrency by market cap, dominates decentralized finance (DeFi) with a $505 billion valuation. Its ecosystem boasts the largest pool of capital, the most expansive dApp network, and the highest developer activity in crypto.

Over the past five years, ETH has surged 1,090%, underpinned by $95 billion in DeFi total value locked (TVL), a $159 billion stablecoin float, and $1.8 million in daily fee generation. These metrics signal robust on-chain activity and long-term viability. Meanwhile, WLFI's potential remains untested against Ethereum's entrenched dominance.

Ethereum Tests Key Support Levels After Sharp Rejection at $4.5K

Ethereum's rally stalled abruptly as prices faced strong rejection NEAR the $4,500 level, sliding back into a critical support zone. The pullback reflects cooling momentum amid persistent outflows, leaving traders questioning whether bulls can hold key levels or face deeper corrections.

Technical indicators paint a mixed picture. The daily chart shows ETH breaking below its recent ascending channel, with the RSI hovering near 40—suggesting weakened bullish momentum without reaching oversold territory. Critical support lies at $4,000, followed by the $3,800 region where the 100-day moving average converges with a larger channel's lower boundary. A hold here could establish a higher low structure, preserving the broader uptrend.

Short-term momentum has turned decisively bearish on the 4-hour chart. ETH's breakdown from the $4,400-$4,800 consolidation range accelerated the decline toward $4,100, with the RSI dipping near 30. While oversold conditions may trigger a relief bounce, the local trend remains bearish unless ETH reclaims $4,400.

Ethereum Treasuries Hit $18B Amid Rising Leverage Concerns

Corporate treasuries are accumulating Ethereum at unprecedented levels, with holdings now valued at nearly $18 billion. Despite ETH's consolidation near $4,100, derivatives data reveals growing leverage risks—the Estimated Leverage Ratio spiked to 0.54 this month, signaling potential volatility ahead.

Institutional confidence remains steadfast, even as traders increasingly favor Leveraged bets over spot accumulation. The market now faces a critical juncture: Will corporate buying pressure offset the threat of liquidation cascades?

Ethereum's Seasonal Trends Suggest Q4 Outperformance

Ethereum (ETH) has historically demonstrated strong performance in the fourth quarter, with median returns around 22% and average gains nearing 24%. This seasonal pattern reflects accumulated investor behavior, where repeated late-year momentum creates a self-reinforcing cycle.

However, the dispersion of results reveals significant volatility—Q4 drawdowns have exceeded 40% in 2016 and 2018. The approval of spot Ether ETFs in May 2024 introduces a structural change, potentially altering historical patterns as institutional flows enter the market through traditional brokerage channels.

Vitalik Buterin Defends Base's Decentralized Security Model as Key L2 Feature

Ethereum co-founder Vitalik Buterin has articulated the critical importance of Base's decentralized consensus mechanism, positioning it as a benchmark for LAYER 2 security. The chain's non-custodial design ensures users retain fund mobility even during operational failures—a defining feature that elevates L2s beyond mere transaction relays for Ethereum.

Buterin emphasized this architecture prevents censorship risks, citing Base's alignment with Ethereum's base layer for security while leveraging centralized components for UX optimization. The model notably contrasts with temporary censorship incidents observed on chains like Soneium.

While such design mitigates custodial risks, Buterin cautioned it doesn't eliminate financial exposure—particularly for DEXs, which remain vulnerable despite non-custodial assurances. His commentary reflects ongoing scrutiny of L2-Ethereum dynamics as scaling solutions mature.

Ethereum Eyes Rebound as Analysts Spot Accumulation Signals

Ethereum's sharp retreat to $4,077—a one-month low—has triggered the largest nominal liquidation event since 2021, with $500 million in ETH positions unwound. Yet the drop appears orderly compared to historic crashes, suggesting controlled deleveraging rather than panic selling.

Market watchers note institutional accumulation continues unabated, with entities like BitMine building positions. "ETH is following the blueprint," says Merlijn The Trader, referencing a technical setup that could propel the asset toward five-digit valuations. The $4,100 support level now serves as a litmus test for bulls.

Vitalik Buterin Praises Base as Ethereum Layer 2 Innovation

Ethereum co-founder Vitalik Buterin and Jesse Pollak have highlighted Base as a significant innovation in Ethereum's Layer 2 ecosystem. The endorsement underscores the growing importance of scaling solutions in the blockchain space.

Base's development aligns with Ethereum's broader vision for scalability and efficiency, positioning it as a key player in the Layer 2 landscape. Buterin's public support adds credibility to the project, potentially driving further adoption among developers and users.

Ethereum Faces Liquidity Crunch Amid $10B Staking Withdrawals and Retail Speculation Surge

Ethereum's Proof-of-Stake network is grappling with unprecedented liquidity pressures as $10.2 billion worth of ETH enters the exit queue, marking a 327% weekly surge. The exodus coincides with staking yields collapsing to 2.84% - the lowest since the Merge - while DeFi protocols like PENDLE attract capital with 5.4% APY offers.

Kiln's 1.6M ETH withdrawal dominates the outflow, representing rotational capital movement post-SwissBorg hack rather than systemic abandonment. Validator interest wanes concurrently, with entry queues shrinking to 320,000 ETH.

Retail traders counterbalance institutional churn through meme coin mania. BullZilla's presale has mobilized $580,000 and 1,900 holders, exemplifying speculative fervor that persists despite Ethereum's structural challenges.

Ethereum Price Drops Hard – $4,000 Now Crucial Line Between Bulls and Bears

Ethereum's price has taken a sharp downturn, slipping below the critical $4,250 support level and now hovering near the $4,000 threshold. The failure to sustain gains above $4,550 has triggered a bearish trend, with ETH trading below both the $4,280 mark and the 100-hourly Simple Moving Average.

A key resistance level looms at $4,360, marked by a bearish trend line on the hourly chart. Should Ethereum manage to reclaim $4,250 and break past $4,320—the 50% Fibonacci retracement level of its recent drop—it could signal a potential recovery. However, the current consolidation near $4,000 leaves the market in a precarious position, with further declines possible if support falters.

Uptick Network Enhances Upward Wallet with ERC-20 Token Creation and Gift Distribution

Uptick Network has upgraded its flagship non-custodial wallet, Upward, with ERC-20 token creation and token-based gift distribution features. The move aims to democratize Web3 access by eliminating technical barriers for everyday users. No coding expertise is required—users need only specify basic parameters like token name, symbol, and supply.

The initiative targets entrepreneurs and communities seeking streamlined token deployment for business or personal projects. By abstracting smart contract complexities, Uptick positions its wallet as a gateway for practical blockchain adoption. The gifting function introduces novel social use cases, enabling token distribution to networks of contacts.

Will ETH Price Hit 5000?

Based on current technical and fundamental analysis, reaching $5,000 represents a challenging but achievable target for ETH. The current price of $4,184.67 requires approximately 19.5% appreciation to hit the $5,000 milestone.

| Metric | Current Value | Bullish Factors | Bearish Factors |

|---|---|---|---|

| Price vs 20-day MA | $4,184.67 (below MA) | Institutional accumulation | MACD negative momentum |

| Key Support | $4,000 | Seasonal Q4 trends | Leverage concerns |

| Distance to $5,000 | 19.5% required gain | Vitalik's L2 innovation | Staking withdrawals |

"The path to $5,000 depends heavily on maintaining the $4,000 support level and seeing renewed institutional buying," explains BTCC financial analyst Robert. "While technical indicators show short-term weakness, the fundamental case for Ethereum remains strong."